-

- July 10, 2024

- 0

Pessimism

“We all agree that pessimism is a mark of superior intellect.” -J.K. Galbraith

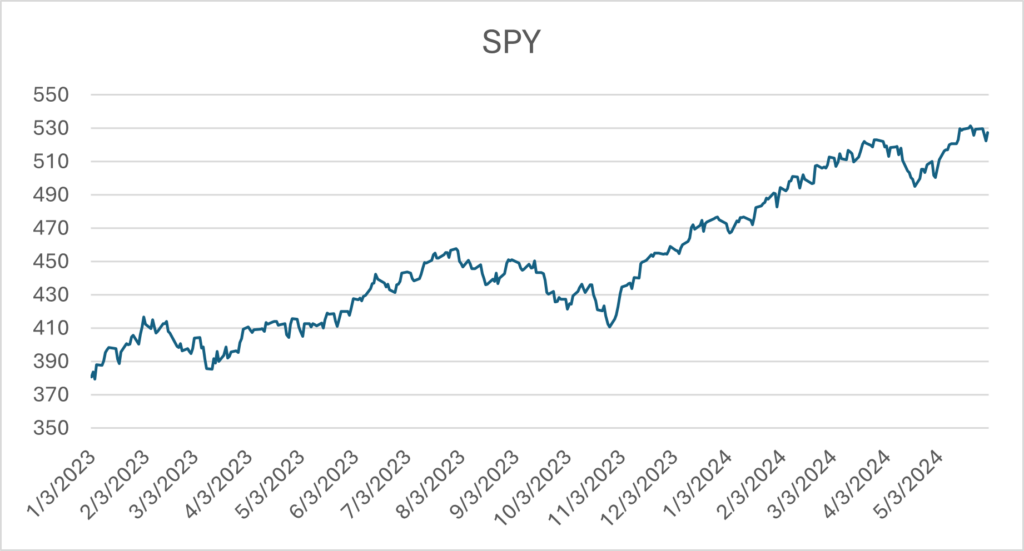

Here is the SPDR S&P 500 ETF Trust (SPY) from the start of 2023 to early May 2024.

Source: Yahoo Finance

Total return was well above the average annual return and conversely, volatility was well below average. The market has been doing very well.

Nevertheless, people love to hear that the world is falling apart. Bearishness isn’t just popular. It is often very compelling and sounds intelligent. Noting that the market has gone up just means you can see a chart, but predicting a crash means you must have done some iconoclastic analysis. You’ve seen something that the herd has missed.

Why do bears sound more intelligent?

One reason is that optimists can appear to be oblivious to risks, particularly the type of catastrophe that hasn’t yet occurred but could in the future (the “peso problem”). The canonical example of this effect hasn’t got anything to do with pesos. It is the story of the Thanksgiving turkey. The turkey thinks life is easy and predictable. Every day he gets fed and goes to sleep in a warm pile of straw. But then Thanksgiving comes around, and the turkey gets a nasty surprise that nothing in his experience could have prepared him for.

I think this argument fails. First, the analogy isn’t nearly as good as it might appear. Sure, it ended poorly for the turkey, but there are millions of house pets who live a pampered life and die peacefully, surrounded by loved ones. Just because it can happen doesn’t mean that it will happen. The fact that a catastrophe hasn’t appeared in the historical data doesn’t mean it will occur in the future. And the available evidence (that is, all the data we have seen) makes it more likely that it won’t appear in the future (Bayes’ theorem).

I think the only intellectually honest way to evaluate this situation is to say, “I don’t know, but neither does anyone else.”

To directly relate this to investing, no one can really say that teeny puts are mispriced. We know that closer-to-the-money puts, for which we have plenty of data to evaluate, tend to be overpriced. We also know that the weak past evidence we have to value teenies suggests they are over-priced. But we can’t really know.

However, pessimists will take “I don’t know” and turn that into “they are cheap.”

Obviously, there will be times when the owners of these puts make money. And, because of the leverage and non-linearity of options, they will make a lot. They will be invited onto TV shows, where they will have great stories to tell. They will probably say their investing is empirically based, but there always seems to be a vivid anecdote as well. So, this success of pessimism is very visible, whereas the years of success of the optimist will largely go un-noticed. What usually happens is never newsworthy. As Margaret Thatcher said, “Of course it’s the same old story. Truth is usually the same old story.”

Equity markets have gone up in the long run for as long as we have had data to analyze. Sometimes bears are correct. But it is our opinion that their arguments will always appear better than they really are. Discount them accordingly.

Disclaimer

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting, or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact HTAA or consult with the professional advisor of their choosing.

Except where otherwise indicated, the information contained in this article is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution of any future date. Recipients should not rely on this material in making any future investment decision.

LEAVE A COMMENT