-

- September 11, 2018

- 0

Sell in May or buy around the midterm election

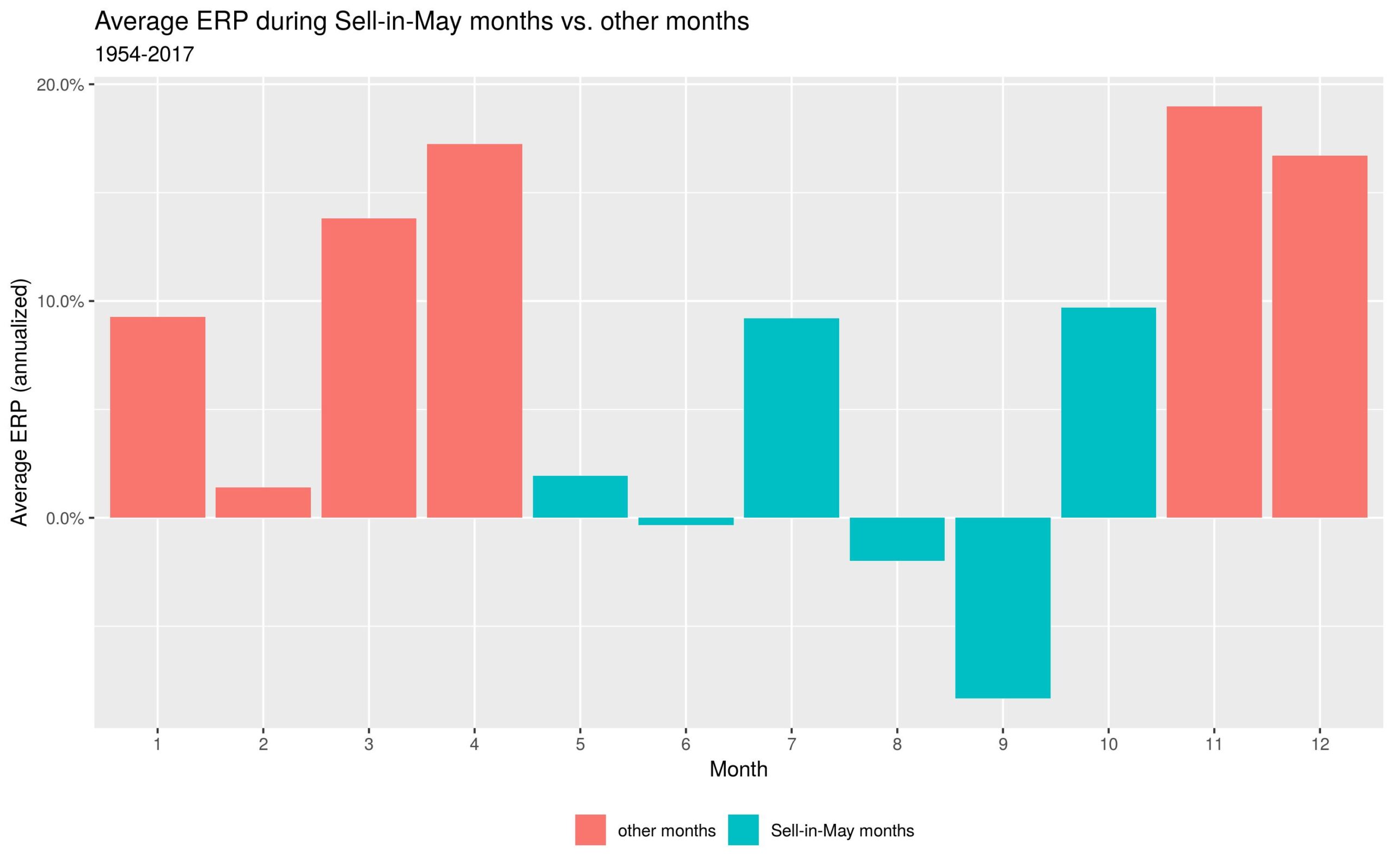

The Seasonal Anomaly and Trend model is one our first shorter term models. One of the components of this model is the Sell-in-May or Halloween effect. The Sell-in-May effect refers to the fact that historically the equity risk premium (“ERP”) between May and October has been lower than during the remainder of the year and therefore it might make sense for some investors to follow the saying “Sell in May and Go Away… and come back in October”. Our empirical findings show that the average ERP between May and October is 11.24% p.a. lower compared to the November to April period, thereby confirming the existence of the effect.

Average ERP (annualized) May-Oct 1.78% Nov-Apr 13.03% Difference 11.24%

Inspired by the findings of Chan and Marsh (2018), we had a second look at how we trade this effect. In their paper, they show that there is a significant premium to be earned post the midterm election, which happens in November of the third year of the presidential election cycle (the first year being the year of the presidential election). Our findings show that the ERP of the S&P 500 is on average 24.92% p.a. higher during the November-April period following the midterm election than on other days. Once we account for this effect, the Sell-in-May effect becomes much less relevant.

What does this observation mean for us? We used to optimize the annual entry and exit points of the Sell-in-May to maximize the Sharpe ratio. This means we were not accounting for which year of the election cycle we were in. Going forward, we will use this additional information to help improve our Seasonal anomaly and Trend model. Depending on one’s point of view, we will increase our equity exposure between October of the third year of the presidential election cycle and April of the fourth year, or decrease the exposure for the remainder of the election cycle. This means our equity exposure, all other things being equal, will likely be slightly higher from November 2018 through April 2019.

©2018 Hull Tactical Asset Allocation, LLC (“HTAA”) is a Registered Investment Adviser.

The information set forth in HTAA’s market commentaries and writings are of a general nature and are provided solely for the use of HTAA, its clients and prospective clients. This information is not intended to be and does not constitute investment advice. The experiments described herein are for discussion and illustrative purposes only and do not reflect actual portfolio results. These materials reflect the opinion of HTAA on the date of production and are subject to change at any time without notice. Due to various factors, including changing market conditions or tax laws, the content may no longer be reflective of current opinions or positions. Past performance does not guarantee future results. All investments are subject to risks. Where data or information is presented that was prepared by third parties, such information will be cited and any such third-party sources have been deemed to be reliable. However, HTAA does not warrant or independently verify the accuracy of such information. HTAA and any third parties listed or identified herein are separate and unaffiliated, are not responsible for each other’s products, policies or services, and the views expressed are their own.

LEAVE A COMMENT