-

- September 27, 2016

- 0

Strategy Management Update

When we introduced our exchange traded fund fifteen months ago, we had a strong belief that a long term market timing model using economic and fundamental data could outperform equities in the long run with less volatility. This conclusion came after nearly five years of research and culminated in our paper A Practitioner’s Defense of Return Predictability.

At the same time we were well aware of the limitations of relying solely on a model with a six-month horizon. There is only so much value added available from even a perfect six-month forecast, let alone an imperfect one. So last November we introduced shorter-term models and created a Short Term Adjustment to our long-term allocation. According to this scheme two-thirds of our daily allocation came from the long-term model and one-third came from shorter-term models.

Fast forward to the present and we have nine models with forecast horizons ranging from one day to six months. They have economic, fundamental, technical, seasonal and sentiment data as inputs. We use statistical methods from ordinary least squares to the most sophisticated machine learning techniques.

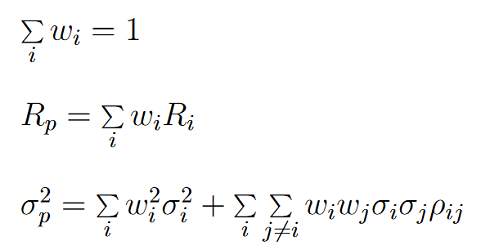

Meanwhile, we are shifting away from classifying models as short-term or long-term. As we go forward, our approach will focus on an ensemble methodology we have developed in house, which combines, in an optimal way, models with different horizons, sources of information and approaches to the problem of capturing useful signals from the multitude of data available to us.

We believe that this decision will add significantly more value than focusing on any single model or approach. Our goal is to continuously evolve our approach and models, in a disciplined and systematic manner, in light of new information sources, techniques and resources.

©2016 Hull Tactical Asset Allocation, LLC (“HTAA”) is a Registered Investment Adviser.

The information set forth in HTAA’s market commentaries and writings are of a general nature and are provided solely for the use of HTAA, its clients and prospective clients. This information does not constitute investment advice, which can be provided only after the delivery of HTAA’s Form ADV and once a properly executed investment advisory agreement has been entered into by the client and HTAA. These materials reflect the opinion of HTAA on the date of production and are subject to change at any time without notice. Due to various factors, including changing market conditions or tax laws, the content may no longer be reflective of current opinions or positions. Past performance does not guarantee future results. All investments are subject to risks.

LEAVE A COMMENT