-

- August 21, 2024

- 0

Alpha & Beta

You may hear traders talk about their “alpha”. “I’ve found some alpha”; “This situation is a good source of alpha”; “I made a lot of money last year because of my alpha.” It is usually used as if it is a synonym for edge, but what is it really?

Alpha is a parameter in the Capital Asset Pricing Model (CAPM). CAPM relates the return of a security or strategy to the return of the market. Originally, “market” was meant to be everything that could possibly be invested in. So, stocks, bonds, commodities, real estate, fine art, and so on. But in practice, “market” is taken to mean an appropriate benchmark. For a stock, we typically use an index.

In its simplest form the equation for CAPM is:

Where rs is the return of the strategy, b is the co-movement of the strategy and the market, a is the part of the return that can’t be attributed to the market and e is the noise that the model doesn’t account for.

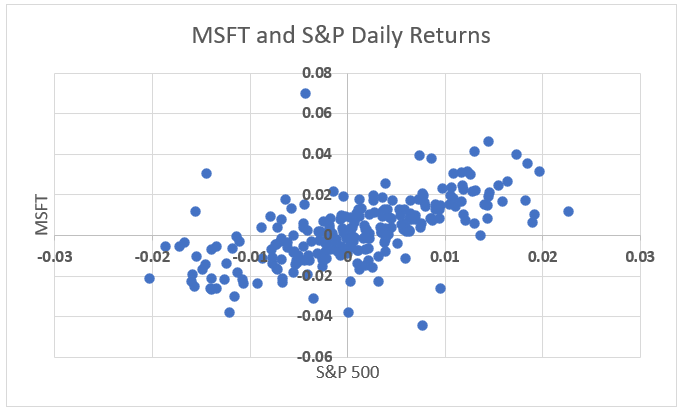

Consider the example of MSFT. The daily returns of MSFT and the S&P 500 for 2023 are shown below.

Using regression to estimate the equation we find:

a=0.001

b=1.153

So, the daily return of MSFT that isn’t attributable to the market is 0.1%.

It is this alpha that stock pickers are trying to find. And it is what they are paid for. As Aaron Brown, the long-time risk manager of AQR, has written, “alpha is what you make.” That is, alpha is the active component of a trader’s strategy, the result of their ability. Beta is available to anyone. You can get the returns due to beta simply by investing in the market. In this case, MSFT will go up 1.15% whenever the S&P goes up one percent. In this regard, there is no difference between buying MSFT and investing 1.15 times as much money in a market fund.

And this is where traders get defensive and want to attribute their success to alpha. Beta is freely available to anyone, but alpha is a skill measure. Beta is easy. Alpha is hard.

But your account doesn’t care. Money from beta is just as good as money from alpha. And easy money is better than hard money. Finding passive (beta) exposures to effects (markets) that have positive returns is a great way to make money. A good trader makes money. A good trader doesn’t care about alpha or beta.

Warren Buffet is a big believer in beta. In fact, he said he said this about how he wanted his fortune to be managed after his death:

“My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund.” – Berkshire Hathaway Inc. Annual Report 2013

It is also important to note that Buffet follows this advice in his own investing. While he certainly holds the concentrated positions, one would expect from a stock picker, his picks are based on the idea of “smart beta”. The idea behind smart beta (also known as factor analysis) is that instead of returns being primarily explained by exposure to the overall market, there are instead sub-betas such as value, size, and low volatility. While academics began publishing papers on this in the 1980s, Buffet was using the concepts in the 1960s. And while he is often categorized as a value investor, his picks were usually stocks with low volatility and high quality (increasing earnings, etc.). He independently discovered these sub-betas and made billions as a result.

The concept of beta as passive exposure to a risk factor is very powerful. Understanding this reduces the incentive to spend a lot of effort on timing exposures. Knowing that you will succeed over the long run is all you need. And it is quite likely that if we dig long enough, we would find that a lot of our “micro-alphas” and really “micro-betas”, exposures to mispriced risk factors. And that’s fine. Our real alpha is how we combine and manage a portfolio of these little edges.

A lot of active investors want to denigrate beta, but we would argue beta is better than alpha. Risk premia are easier to find, and can last for years, decades or lifetimes.

Money is money. Your account doesn’t care about Greek letters.

Disclaimer

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting, or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact HTAA or consult with the professional advisor of their choosing.

Except where otherwise indicated, the information contained in this article is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution of any future date. Recipients should not rely on this material in making any future investment decision.

LEAVE A COMMENT