-

- July 2, 2024

- 0

Political Donations

The next Presidential election is in November, and we will write more about the relationships between elections and the markets as the date comes closer. But America is now in a permanent campaign mode, so politics is always relevant.

Before we look further, we need to give a warning that political studies are very prone to two problems. The first is particularly obvious. Political studies are often, well, political. At a minimum, check the affiliations of any authors and make sure that they aren’t obviously politically invested. Second, small samples can be an issue. For example, since 1990 (when the VIX was introduced and hence, what I would arbitrarily define as the start of the modern era of finance) there have only been 6 American presidents (three Democratic and three Republican). And finally, clearly, conclusions are country specific as different countries have very different systems governing elections, political donations, and lobbying.

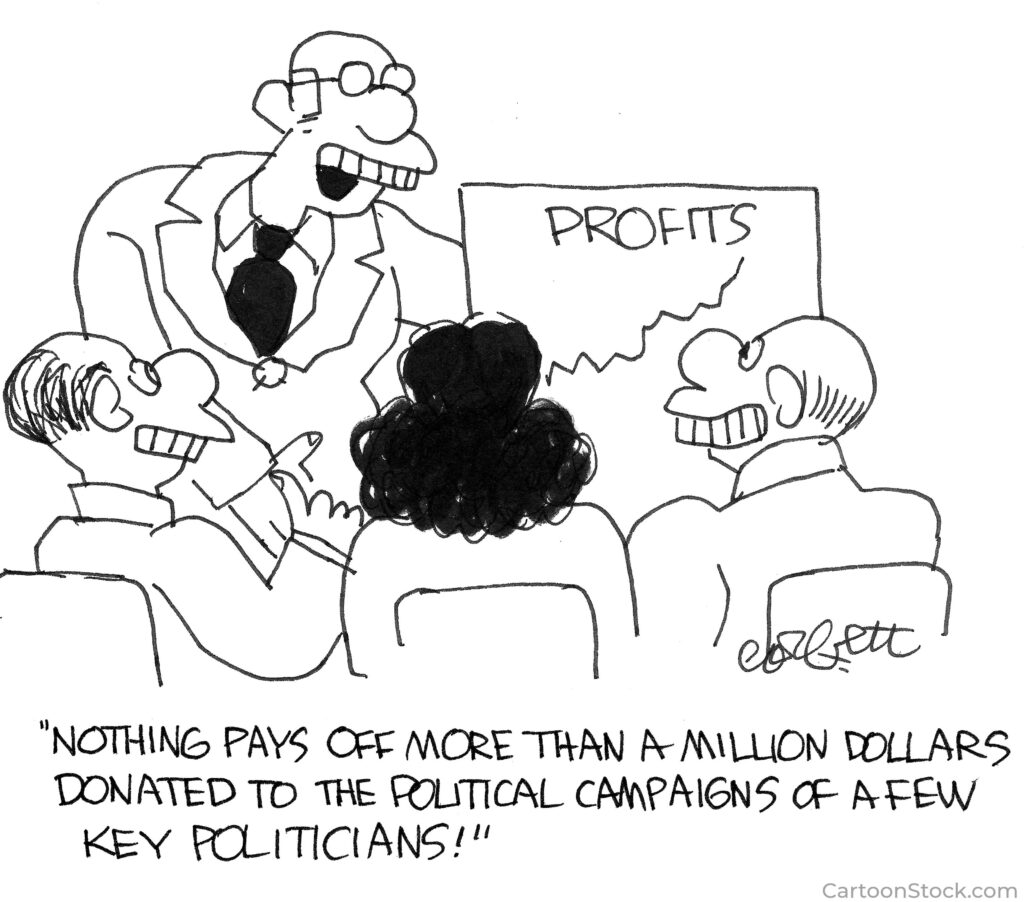

But we can gain information by tracking the political donations that companies make.

Many companies make political donations, and often to members of both political parties. There must be some reason the practice is so common. So what effect, if any, do these donations have on future stock returns?

This has been studied several times. We will summarize some findings here.

In “Corporate Political Contributions and Stock Returns” Michael Cooper, Huseyin Gulen, and Alexei Ovtchinnikov studied the data from the FEC (Federal Election Commission) on PAC contributions between 1979 and 2004. This data set contained over 800,000 contributions by 1,930 companies. A summary of their results is:

- The average contributing company donates to 73 candidates in any five-year period.

- The number of candidates a company supports correlates significantly with future stock returns. One standard deviation over the average corresponds to a 0.5% increase in monthly returns.

- This effect seems to be driven by the fact that donating companies see a significant increase in their return on equity.

- The companies that benefit most from contributing are:

-

- Those that have long-term relationships with particular politicians, particularly home state politicians.

- those that contribute to Democratic candidates.

- Those that contribute to congressmen.

Whether this is just an example of smart management working within the system, or an example of corruption isn’t important for our purposes. Our takeaway is that the return to politically active companies is of the same order as the other factors such as value, size, momentum and quality. This general conclusion has been corroborated by other studies, both generally and in specific industries. The effect is also present when we consider “softer” forms of buying political influence such as appointing politically connected board members.

Because this post is about politics, about half the readers will be outraged and half will think this is the best possible system. But try not to let that response bias your judgement. You invest in the world that is, not in the one that you want.

Disclaimer

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting, or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact HTAA or consult with the professional advisor of their choosing.

Except where otherwise indicated, the information contained in this article is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution of any future date. Recipients should not rely on this material in making any future investment decision.

LEAVE A COMMENT