-

- June 4, 2024

- 0

The Baltic Dry Shipping Index

The Baltic Dry Shipping Index (“BDI”) is a freight cost index published by the London Baltic Exchange. The “Baltic” part of the name comes from the exchange. It does not indicate that the index only includes prices from routes in the Baltic Sea. The index includes data from routes all over the world.

Road in London, November 2020

Baltic Sea Area Map

The exchange is one of the oldest in the world and the shipping industry has always been an important part of economic and financial ecosystems. Shipping is, and has always been, the most important trade infrastructure. About 90% of the world’s physical trading is done by sea. Maritime power is how a small, and not particularly rich or technologically advanced, country in north-west Europe came to dominate the world for hundreds of years. And some of the earliest derivative contracts were insurance policies between Phoenician merchants.

Because shipping is an indicator of economic activity, it seems reasonable that there is a link to the stock market. And, for similar reasons, traders have long believed that the Dow Jones Transportation Index is predictive. Of course, plenty of “reasonable” ideas amount to nothing, and it also isn’t clear that shipping data leads the market.

The first formal, statistical study of this idea was by Gurdip Bakshi, George Panayov, and Georgios Skoulakis in their paper, “The Baltic Dry Index as a Predictor of Global Stock Returns, Commodity Returns and Global Economic Activity” (2012 Chicago AFA Meetings paper).

Using data from 1985 to 2010, they found that the BDI returns have a positive relationship to the returns of stock markets at the monthly and quarterly durations. The markets they looked at included four regional equity indices, 19 developed nation indices, and 12 emerging nation indices. Statistically significant evidence of out-of-sample predictive power was found for all the regional indices, 15 of the developed countries, and 6 of the emerging nations.

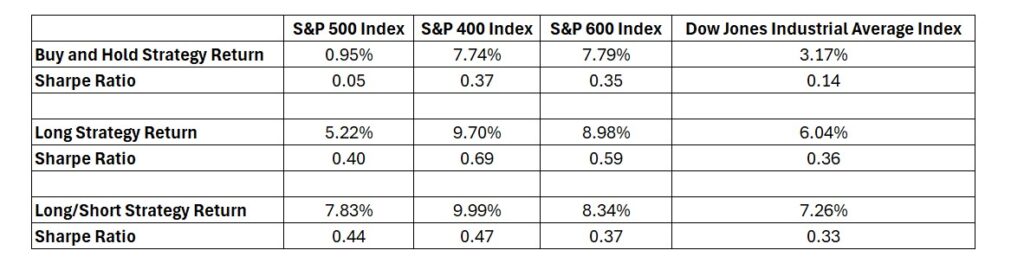

Amir Alizadeh and Gulnur Muradoglu used the BDI to implement simple trading strategies (“Stock Market Returns and Shipping Freight Market Information: Yet Another Puzzle!”). The strategy was very simple. For the long/short strategy, each month they went long or short depending on whether the BDI went up or down in the last month. The long only version would be either long or in T-Bills. Returns and Sharpe ratios for the major indices between 2000 and 2010 are shown in the table below (from their paper).

All the usual caveats about academic studies apply here. Specifically, costs aren’t included, the Sharpe ratio is calculated assuming a rate of zero and the indices can’t be directly traded. Nonetheless, the results are encouraging, and the general idea holds up: the BDI is predictive.

Disclaimer

HTAA, LLC serves as the investment advisor to the Fund. The Fund is distributed by Northern Lights Distributors, LLC., which is not affiliated with HTAA, LLC or any of its affiliates. HTAA is not affiliated with Ultimus Fund Solutions, LLC or any of its affiliates.

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus, which may be obtained by visiting www.hulltacticalfunds.com. Read the prospectus carefully before investing.

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting, or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact HTAA or consult with the professional advisor of their choosing.

Investing involves risk, including the possible loss of principal. Investments in smaller companies typically exhibit higher volatility. The Fund will invest in (and short) exchange-traded funds (ETFs). The Fund will be subject to the risks associated with such vehicles. The Fund may also invest in leveraged and inverse ETFs. Inverse and leveraged ETFs are designed to achieve their objectives for a single day only. For periods longer than a single day, leveraged or inverse ETFs will lose money when the performance of the underlying index is flat over time, and it is possible that a leveraged or inverse ETF will lose money over time even if the level of the underlying index rises or, in the case of an inverse ETF, falls. In addition, shareholders indirectly bear fees and expenses charged by the underlying ETFs, as well as the Fund’s direct fees and expenses. The Fund may invest in derivatives, including futures contracts, which are often more volatile than other investments and may magnify the Fund’s gains or losses.

The Fund is an actively managed ETF and, thus, does not seek to replicate the performance of a specified passive index of securities.

The Fund may take short positions. The loss on a short sale is theoretically unlimited. Short sales involve leverage because the Fund borrows securities and then sells them, effectively leveraging its assets. The use of leverage may magnify gains or losses for the Fund.

There is no guarantee that any investment strategy will produce positive results. There is no guarantee that distributions will be made.

LEAVE A COMMENT