-

- December 2, 2020

- 0

Some More on the Halloween Effect

Most things that seem too good to be true are actually not true. This applies particularly to the markets where making money is hard and there are plenty of snake oil salesmen who will tell you otherwise. So it is perfectly sensible to be skeptical about something as promising as the Halloween Effect. In particular, does it still work?

If we look at results since 2000 (using the free data at yahoo finance), the answer is “yes”.

Figure One: The value of $100 invested during summer from 2000 to 2020.

Figure Two: The value of $100 invested during winter from 2000 to 2020.

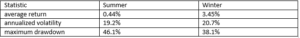

Table One gives the summary statistics for each season. As in the full period from 1950 to 2020, winter has higher returns. The volatility is very slightly higher in winter this time but the maximum drawdown is much higher in summer.

Table One: Summary statistics.

So the Halloween Effect might appear to be too good to be true, but appearances can be deceiving.

LEAVE A COMMENT