-

- September 12, 2018

- 0

Time to Raise the Yellow Flag?

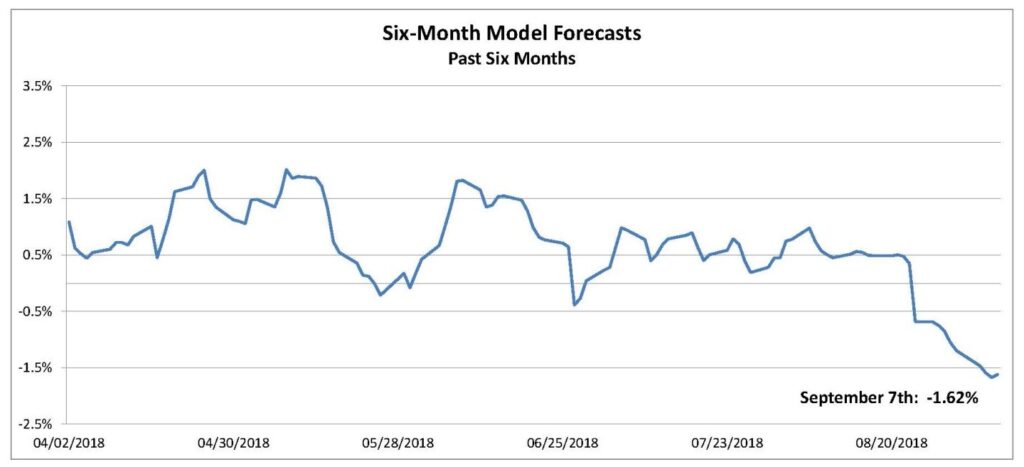

About two weeks ago our six-month equity risk premium model went negative. Since then the forecast has continued to go down suggesting that investors approach the U.S. stock market with caution.

Chart 1 ERP Forecasts in the Past Six Months. Source: Hull Tactical.

What has caused the forecast to drop? One factor is equity valuation. Measures like price-to-earnings and price-to-book value are well above their historical averages. A second factor is inflation. Although the break-even rate on inflation protected Treasury bonds has held steady for the past six months, the year-over-year change in the Consumer Price Index has risen 75 basis points in the same period. New orders and shipments and the Baltic Dry Index are also negative factors now according to our work. Meanwhile, the FRB Loan Officer Survey shows that bankers continue to accommodate borrowers. This is the only major positive factor that is partially offsetting the aforementioned negatives.

We looked at monthly averages of our daily ERP forecasts to try to get a perspective on what the current negative forecast means for the stock market. Going back to 2001, we sorted the monthly averages from lowest to highest. We divided the data set into five groups and found the following:

Table 1 Average monthly forecasts by quintile and subsequent returns on the S&P 500

Next Month Next 3 Months Next 6 Months Quintile 1 -0.94% -2.42% 0.52% Quintile 2 0.68% 3.27% 5.59% Quintile 3 1.01% 3.56% 6.95% Quintile 4 0.68% 2.08% 3.03% Quintile 5 1.97% 4.14% 6.45% Quintile 1 represents forecasts in the bottom fifth of the group; Quintile 5, the top fifth. Broadly speaking, subsequent returns rise as average monthly forecasts rise.

As it turns out, the current ERP forecast has entered “Quintile One” territory. On average, when this has occurred, the next month and three-month returns have been negative; the six-month returns, barely positive. But it is not a lock that stock prices will decline. Indeed, only 43% of the three-month outcomes have been negative when forecasts have entered Quintile 1 territory.

Here’s a more sobering way to look at it. Since 2001, three-month returns on U.S. stocks have ranged from minus 30% to a plus 26%. When the ERP forecast has been in the bottom quintile as discussed the above, the range of returns realized over the next three months compresses to a low of minus 30% and a high of plus six percent. In short, conditions suggest that investors are currently being offered all of the downside the stock market has to offer, but very little of the upside. The more constructive take is that equity returns are likely to be below average, though not necessarily negative, in the coming months.

Readers with an interest in our daily forecasts and how we arrive at them may follow this link to our Daily Report.

©2018 Hull Tactical Asset Allocation, LLC (“HTAA”) is a Registered Investment Adviser.

The information set forth in HTAA’s market commentaries and writings are of a general nature and are provided solely for the use of HTAA, its clients and prospective clients. This information is not intended to be and does not constitute investment advice. These materials reflect the opinion of HTAA on the date of production and are subject to change at any time without notice. Due to various factors, including changing market conditions or tax laws, the content may no longer be reflective of current opinions or positions. Past performance does not guarantee future results. All investments are subject to risks. Where data or information is presented that was prepared by third parties, such information will be cited and any such third-party sources have been deemed to be reliable. However, HTAA does not warrant or independently verify the accuracy of such information.

LEAVE A COMMENT