-

- January 12, 2017

- 0

CAY Takes a Leave of Absence

CAY, a valuation measure that looks at the relationship between consumption, income and wealth, has been removed from our Equity Risk Premium Model. This comes as a result of our correlation screening process (done every 20 trading days) that judges whether explanatory variables should be included in the estimation and forecasting process. If a variable’s correlation falls below a set threshold, the variable is removed from the model. We have used the term “leave of absence” because it is possible that CAY will bounce back and be re-inserted into the model. Time will tell. Correlation screening is discussed in more detail in our paper called “A Practitioner’s Defense of Return Predictability.”

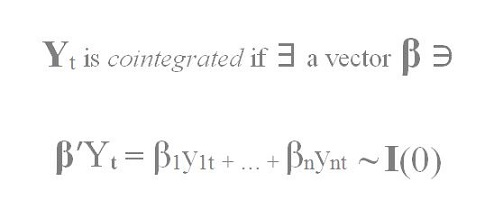

CAY is the result of research published by Professors Martin Lettau and Sydney Ludvigson in a paper called “Consumption, Aggregate Wealth, and Expected Stock Returns” in the June 2001 issue of The Journal of Finance. According to the authors, “fluctuations in the aggregate consumption-wealth ratio are strong predictors of both real stock returns and excess returns over the Treasury bill rate.” The consumption-aggregate wealth ratio – human capital plus asset holdings – is not directly observable however, so the authors used a combination of consumption, income and wealth to estimate the consumption-aggregate wealth ratio.

That CAY’s effect has diminished is not wholly unexpected. In an August 2016 National Bureau of Economic Research working paper called “Monetary Policy and Asset Valuation: Evidence from a Markov Switching CAY, “ professors Lettau, Luvigson and Francesco Bianchi observed that “over time, the statistical properties of the estimated series appear to have shifted in some fundamental ways.” They report that the average value of CAY can change, possibly in response to long-run expectations of Federal Reserve policy.

Could this be a big mistake – dumping a valuation measure after the S&P 500 has more than tripled in value since March 2009? We think not. CAY is one of many variables we monitor for our Expected Risk Premium model. Meanwhile, our Expected Risk Premium model is one of several in our ensemble of models.

All factors and predictors can experience some degree of decay. Some become irrelevant, others come and go based on a regime, state or other factor. That’s why we prefer our ensemble approach to drive our daily forecasts, rather than relying on a single variable or a single model.

©2017 Hull Tactical Asset Allocation, LLC (“HTAA”) is a Registered Investment Adviser. The information set forth in HTAA’s market commentaries and writings are of a general nature and are provided solely for the use of HTAA, its clients and prospective clients. This information is not intended to be and does not constitute investment advice. These materials reflect the opinion of HTAA on the date of production and are subject to change at any time without notice. Due to various factors, including changing market conditions or tax laws, the content may no longer be reflective of current opinions or positions. Past performance does not guarantee future results. All investments are subject to risks. HTAA and any third parties listed or identified herein, including The Journal of Finance and the National Bureau of Economic Research, are separate and unaffiliated, are not responsible for each other’s products, policies or services, and the views expressed are their own.

LEAVE A COMMENT