-

- June 15, 2016

- 0

INVESTMENT STRATEGISTS: KNOW THY FORECASTS

Investors who use quantitative forecasts to inform their trading have a two-part problem. First, they must come up with market forecasts on a regular basis. Second, they must devise a trading strategy based on the forecasts. We think this second step is crucial and we spend a lot of time trying to devise the optimal use of the forecasts, which for us means getting the best tradeoff between risk and return from an investment strategy.

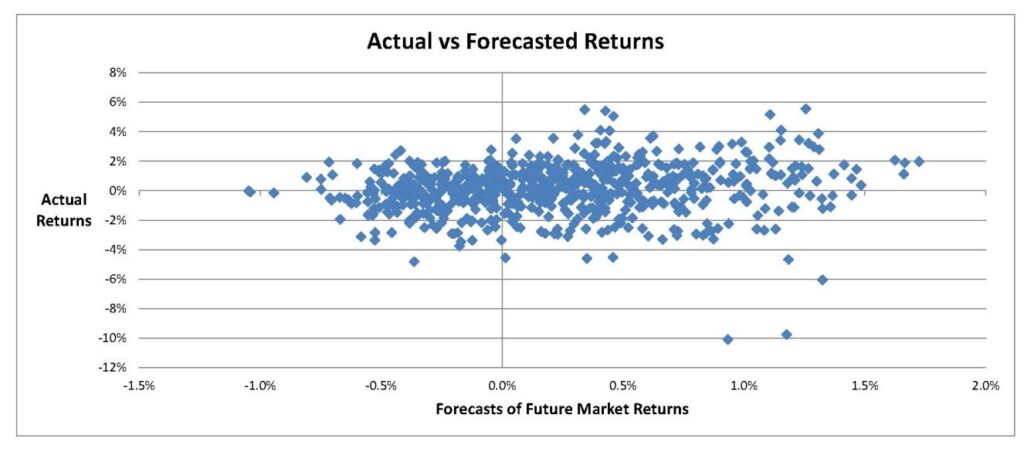

One way to explore forecasts and outcomes is to create a scatter plot with forecasts in the horizontal axis and “actuals” in the vertical access. Here is an example of a scatter plot:

Is the relationship obvious or does it look like an inkblot test? Here is the same chart with a linear trend line added:

The trend line is barely going uphill, indicating a weak positive relationship between the forecasts and the actual market returns. The actuals are “compressed” compared to the forecasts, far away from the ideal, which would be depicted by a trend line with a slope of 45 degrees.

This is something financial quants have to live with: Relationships between predictor variables and market returns are very weak at best. What is more, relationships can be unstable. They can come and go and they do not give advance notice when they are going.

Some variables get the direction of the market more or less right but say very little about how much the market may go up or down. We generally like to bet in proportion to the strength of our forecasts, but in cases like these we are forced to use a discrete signal that could a simple as “on” or “off”.

To conclude, while it is important to generate good forecasts, it is just as important to know them well. That is the key to translating them into the best possible trading strategy.

©2016 Hull Tactical Asset Allocation, LLC (“HTAA”) is a Registered Investment Adviser.

The information set forth in HTAA’s market commentaries and writings are of a general nature and are provided solely for the use of HTAA, its clients and prospective clients. This information does not constitute investment advice, which can be provided only after the delivery of HTAA’s Form ADV and once a properly executed investment advisory agreement has been entered into by the client and HTAA. These materials reflect the opinion of HTAA on the date of production and are subject to change at any time without notice. Due to various factors, including changing market conditions or tax laws, the content may no longer be reflective of current opinions or positions. Past performance does not guarantee future results. All investments are subject to risks.

LEAVE A COMMENT